Other fees might be for extra services like setting up employee benefits or providing reports. Generally, businesses can expect to spend between $30 and $100 per person each month for outsourcing payroll services. Once a business has hired its first employee, payroll responsibilities will continue every pay period as long as the business is in operation. The complexities of payroll processing may require a considerable time commitment on a daily and weekly basis — time you can’t make up elsewhere.

Resources

Perhaps even more concerning is the increased risk of a breach of sensitive data that outsourcing inevitably brings. While many cloud-based programs for payroll data management use encrypted servers and firewalls for security, they are juicy targets for malicious activity. For most of the 20th century, companies strove to own and exercise control over all business functions and assets. Economic theories of the day advocated growth in all reasonable directions to exploit economies of scale. This mindset of vertical integration extended into companies’ internal processes as well.

When choosing a payroll outsourcing provider, it’s important to remember what’s at stake. A good provider will make things easy for the client, but client companies shouldn’t be lured into a false sense of security. Take the time to make sure a provider is both trustworthy and experienced to minimize these inherent risks of outsourcing. Naturally, the quality of payroll outsourcing will vary, but it’s clear many companies still see these third-party payroll managers as more effective than internal capabilities.

It’s vital to complete tax-related tasks accurately and make payments on time, whether to the state or your employees. That’s why the first thing you should consider when hiring a payroll outsourcing provider is establishing trust. Payroll providers can also ultimate guide to financial statement review and compilation handle payroll taxes and ensure you comply with local tax regulations, regardless of where employees are from.

What are the four primary payroll outsourcing models?

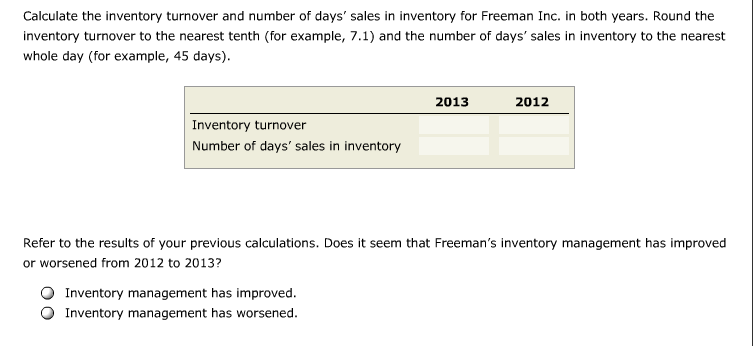

There are pros and cons to every business decision and payroll outsourcing is no different. Before partnering with a full-service payroll provider, employers should make sure the vendor is capable of meeting all of their requirements and has a reliable track record. As mentioned before, these are further areas where a misstep by a payroll outsourcing provider can become a problem for both the provider and the client company. If a company is outsourcing internationally, it shouldn’t assume that it can ignore employment regulations in the provider’s country, as these can be very different from those in the United States. Finding a trustworthy third-party provider goes a long way, but a company can’t just pass off any payroll mistakes that arise as the fault of its provider days in inventory formula and move on.

Generally, they involve set monthly or annual fees, plus extras for additional services. Some payroll providers also include hidden fees but, in most cases, you can budget more effectively. Payroll co-sourcing is a type of payroll outsourcing in which a third-party payroll provider and employees of the business share payroll processing responsibilities. That way, a small business is getting the best of both worlds, allowing them to selectively decide what aspects of payroll they do themselves and which they’d rather have done by the experts. The only types of businesses that identify payroll management as a core function are, well, the payroll outsourcing providers themselves. Outsourcing payroll stands to greatly reduce a major administrative distraction for most companies, allowing them to “cut the fat” from their employee rosters and keep their organizations focused on other tasks.

Clean up your payroll data

It wasn’t until the late 1980s that many companies, hindered by bloated internal structures, began to see broad strategic value in “hiring away” work once completed in-house. Once the possible cost savings of the practice became clearer, there was no turning back. With Deel’s Global Payroll solution, all of that work and worry is taken off your plate. Run payroll around the world from one platform, streamline international operations, and eliminate the ongoing admin of local compliance, taxes, benefits, and more. Small businesses may benefit from working with a contractor as it’s less costly.

- When you partner with a PEO, all required payroll tax returns and payments are handled end-to-end.

- These include automation, cloud-based global solutions, and stronger data security.

- Ideally, there will be an API option, too, so that you can customize your integrations.

- It pays to do your homework and assess your business needs before making a decision.

- Alternatively, to make things easier again, you can simply partner with an all-in-one global HR provider, like Remote, and have everything under one roof.

Given these complicated tasks and the potential for mistakes, processing payroll on your own can cost earnings before tax ebt you more overall than what you may save initially with a DIY solution. These mistakes can lead to audits and penalties — situations no business wants or needs. According to the IRS, audits on 1,014,090 businesses resulted in the assessment of civil penalties totaling over $3.4 billion in fiscal year 2022.