Offshore bookkeeper companies are located in India and other countries, where it costs less to hire such service providers. Essentially, you’ll give a third-party bookkeeper access to important financial information like bank statements, payroll, tax documents, and your accounting software. They’ll take it from there, generating financial reports, ensuring your ledgers are up to date, and tracking money that goes both in and out of the company, among other essential tasks.

- Without a great bookkeeper, your company could be losing thousands of dollars each period.

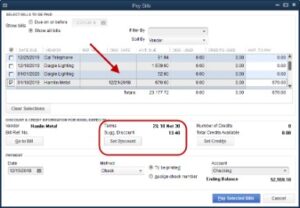

- Financial software can be complex and unintuitive when you are first learning to use it, and your accountant can help you implement these types of new financial technology into your reporting and daily workflow.

- We do all the heavy lifting for you, giving you peace of mind and allowing you to focus your time, money, and resources on running and growing your business.

- Another major risk is receiving low-quality accounting and bookkeeping services, an issue that can be mitigated by using a local or well-established accounting and finance team.

- By closely monitoring your cash flow with the assistance of professionals, you can optimize your financial resources and make informed decisions that support the growth of your business.

Get the week’s best financial automation content.

So if you’re in need of a bookkeeper that’s dedicated to helping you and your business succeed, schedule a free bookkeeping consultation and learn if QuickBooks Live Bookkeeping is right for your business. Simply put, outsourcing is the action of one company hiring another company to perform its specific internal services. When you consider external accounting or bookkeeping services, you want to hire an outside service to fulfill all of your small business accounting tasks and finance responsibilities. FreshBooks offers support from highly knowledgeable help centre staff, along with dedicated account management, advisory services, and connections to expert accountants near you. Freshbooks has advanced tools, including accounting software that gives you 24/7 access to financial data.

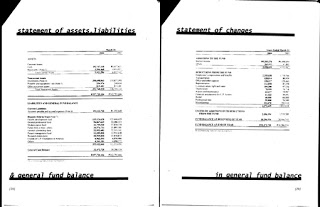

Businesses can eliminate unnecessary back-and-forth between different departments or external service providers by integrating these functions. Instead, they can consolidate their financial information how much does bookkeeping cost in one place, making it easier to access and analyze data for tax reporting purposes. Businesses must work with bookkeeping outsourcing services that understand and adhere to GDPR regulations, ensuring that personal data is handled and stored securely. It is essential to assess the service provider’s data protection measures, including encryption protocols, access controls, and data breach response plans.

First, local bookkeeping is usually done with pen and paper, while virtual bookkeeping takes this service into the digital realm. Staying up to date with the latest software and accounting function tools available in the market will ensure you keep up with the times so your company can thrive. Next, we will explore in detail the process of finding the right bookkeeping service in Section 3. Freelance bookkeepers may be able to work online, in-person at your business, or both. You’ve started a business, made some purchases, logged sales, and now comes the task of recording it all. We wouldn’t blame you the 6 steps in business forecasting if you shudder at the thought of tracking all your transactions, but if you outsource bookkeeping responsibilities, you’ll never have to worry about it.

Pay your team

These providers invest heavily in cybersecurity to ensure that your financial data is safe from breaches and unauthorized access. This level of security often surpasses what a small or mid-sized company can implement on its own, providing peace of mind and safeguarding your financial information. Outsourced bookkeeping services play a key role in ensuring accuracy and compliance. Professional bookkeepers are well-versed in tax regulations and stay up-to-date with changes in tax laws. They possess the knowledge and expertise to accurately classify and record financial transactions in a manner that meets tax reporting requirements.

Compliance and Security in Bookkeeping Outsourcing

For example, if a business experiences rapid growth or seasonal variations, a virtual bookkeeping service allows for flexibility without the burden of hiring and training additional staff. By leaving complex and time-consuming financial tasks to experts, businesses can minimize errors and ensure accurate record-keeping. Outsourced bookkeeping services employ state-of-the-art security measures, including data encryption, multi-factor authentication, and regular security audits, to protect your business finances.

Outsourced bookkeeping works by delegating your business’s financial management tasks to external professionals or firms specializing in bookkeeping and accounting services. You can hire a freelance bookkeeper for different CFO services to give you peace of mind. Here’s everything you need to know about outsourced bookkeeping to help you get started and streamline your day-to-day operations. Moreover, integrating bookkeeping and tax preparation streamlines the entire financial management process, saving time and cost. Businesses no longer need to allocate separate resources for bookkeeping and tax-related tasks.

At some point, you may find it more beneficial to move some or all of your accounting processes in-house. But the majority of companies just want to meet their obligations with minimal fuss, and entrust the heavy lifting to trained experts. If you’re communicating clearly with a trustworthy partner, this doesn’t need to be a negative. Also, take all relevant steps to protect sensitive financial and employee information during data transfers.

Moreover, the cost of software licenses for accounting tools, which can range from $300 to $800 per year per user, is also absorbed by the outsourced provider. By leveraging accounting and bookkeeping services offered by outsourced providers, businesses can scale up their operations confidently, knowing that their financial management is in capable hands. During tax season, many bookkeeping service providers offer special deals and packages, 71 passive income ideas to stop trading time for money which can be more cost-effective than handling them in-house.